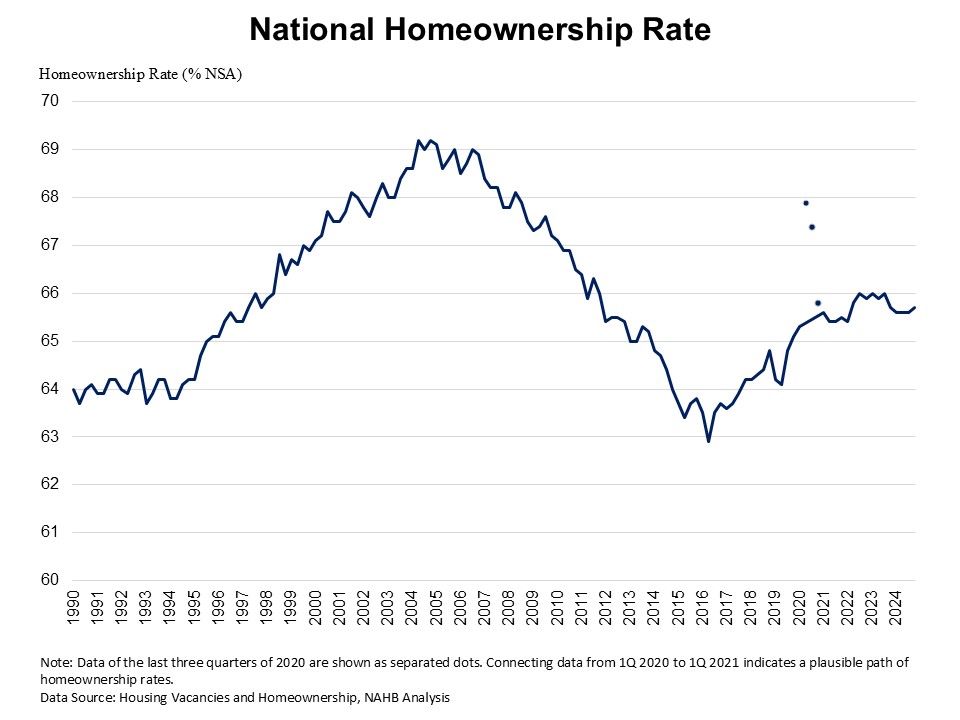

Homeownership Rate for Younger Households Declines

The homeownership rate for those under the age of 35 dropped to 36.3% in the last quarter of 2024, reaching the lowest level since the third quarter of 2019, according to the Census’s Housing Vacancy Survey (HVS). Amidst elevated mortgage interest rates and tight housing supply, housing affordability is at a multidecade low. The youngest age group, who are particularly sensitive to mortgage rates, home prices, and the inventory of entry-level homes, saw the largest decline among all age categories.

The U.S. homeownership rate inch up to 65.7% in the last quarter of 2024, hovering at the lowest rate in the last two years. The homeownership rate remains below the 25-year average rate of 66.4%.

The national rental vacancy rate stayed at 6.9% for the last quarter of 2024, and the homeowner vacancy rate inched up to 1.1%. The homeowner vacancy rate remains close to the survey’s 67-year low of 0.7%.

Homeownership rates declined for under 35 and 35-44 age groups compared to a year ago. Householders under 35 experienced the largest drop, declining by 1.8 percentage points from 38.1% to 36.3%. The 35-44 age group also saw a 0.6 percentage point decrease, decreasing from 62% to 61.4%. Conversely, homeownership rates for householders aged 45-54 increased from 70.3% to 71%. Among those aged 55-64, homeownership inched up slightly from 76% to 76.3%. Those 65 years and over experienced a modest increase from 79% to 79.5%.

The housing stock-based HVS revealed that the count of total households increased to 132.4 million in the last quarter of 2024 from 131.1 million a year ago. The gains are due to gains in both renter household formation (509,000 increase), and owner-occupied households (783,000 increase).

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.